Payment orchestration platforms have emerged as essential infrastructure for businesses managing complex global payment operations. Rather than juggling multiple payment service providers (PSPs) individually, companies now access sophisticated platforms that unify payment routing, optimize transaction success rates, and provide centralized control over their entire payment stack.

This approach particularly benefits growing e-commerce businesses expanding internationally, SaaS companies processing recurring payments globally, and marketplaces managing multi-party transactions. Instead of building custom payment infrastructure or dealing with vendor lock-in from single providers, orchestration platforms offer flexibility to optimize costs, improve approval rates, and adapt quickly to changing market conditions.

The payment orchestration market has evolved from basic payment routing to sophisticated platforms that include fraud prevention, compliance automation, analytics, and no-code configuration tools. Modern platforms handle everything from smart transaction routing to automated retry logic, turning payment operations from a technical burden into a strategic advantage.

Understanding Payment Orchestration Benefits

Traditional payment processing typically involves direct integration with individual payment providers, creating technical debt and limiting flexibility. Payment orchestration platforms solve these challenges by providing a unified layer that sits between merchants and multiple payment service providers.

Improved Authorization Rates represent the most immediate benefit of payment orchestration. By intelligently routing transactions to the best-performing PSP for each specific transaction type, geography, or customer profile, businesses often see approval rate improvements of 15-30%. This happens because different providers excel in different markets, and orchestration platforms automatically select the optimal route for each payment.

Cost Optimization occurs through multiple mechanisms including routing to the lowest-cost provider for specific transaction types, negotiating better rates through aggregated volume, and reducing failed payment costs through smart retry logic. Many businesses reduce overall payment processing costs by 10-20% while simultaneously improving performance.

Operational Efficiency dramatically improves through unified reporting, automated reconciliation across all providers, and simplified compliance management. Instead of maintaining separate integrations and monitoring multiple dashboards, businesses manage their entire payment operations through a single interface.

Risk Mitigation comes from eliminating single points of failure through provider diversification. If one PSP experiences downtime or changes terms unfavorably, transactions automatically route to alternative providers without service disruption. This redundancy proves especially valuable for businesses processing high transaction volumes.

Global Expansion Capabilities accelerate through instant access to local payment methods and regional PSPs without individual integrations. Orchestration platforms maintain connections to hundreds of payment methods worldwide, allowing businesses to enter new markets quickly with locally preferred payment options.

Leading Payment Orchestration Platforms

1. Primer

Primer operates as a unified infrastructure platform that combines payment orchestration with no-code workflow building capabilities. The platform enables merchants to design, test, and optimize their entire payment experience without requiring engineering resources for each modification.

What distinguishes Primer is their drag-and-drop workflow builder that allows non-technical teams to create sophisticated payment flows including conditional routing, retry logic, and fraud prevention rules. This approach enables rapid experimentation and optimization without development bottlenecks.

The platform currently integrates with over 45 payment services across 20+ countries, including major providers like Stripe, Adyen, Apple Pay, and Braintree, alongside specialized fraud screening and tax calculation services. Their unified API approach means a single integration provides access to the entire ecosystem.

Primer has raised $50 million at a $425 million valuation, demonstrating strong investor confidence in their approach to democratizing payment optimization through no-code tools.

Key Features:

- Drag-and-drop workflow builder for non-technical teams

- Unified API connecting 45+ payment services

- No-code payment flow optimization and A/B testing

- Real-time analytics and performance monitoring

- Automated compliance and fraud prevention integration

Pricing: Custom pricing based on transaction volume and requirements

Best For: Mid-market to enterprise businesses wanting flexible payment experimentation without engineering overhead

2. Gr4vy

Gr4vy provides a cloud-native payment orchestration platform built specifically for enterprise merchants requiring sophisticated payment operations. The platform offers Infrastructure-as-a-Service (IaaS) capabilities that give merchants complete control over their payment stack while maintaining cloud scalability.

The company has raised $27.2 million in Series A funding and achieved a $115 million valuation, positioning them as a well-funded player focused on enterprise-grade orchestration. Their cloud-native architecture enables rapid scaling during peak periods and geographic expansion without infrastructure management.

Gr4vy’s strength lies in their enterprise-focused approach, providing advanced features like multi-PSP load balancing, adaptive retry logic, and sophisticated routing rules that can handle complex business requirements. Their platform emphasizes merchant control and vendor independence.

Key Features:

- Cloud-native infrastructure with automatic scaling

- Advanced routing and load balancing across PSPs

- No-code configuration interface for payment flows

- Enterprise-grade security and compliance automation

- Real-time performance optimization and analytics

Pricing: SaaS subscription model with revenue sharing options

Best For: Enterprise merchants with complex payment requirements and high transaction volumes

3. Spreedly

Spreedly operates as an open payments platform that enables businesses to connect multiple PSPs and payment methods through a single API integration. Founded in 2008, the company represents one of the established players in the payment orchestration space with extensive experience serving platforms and fintechs.

The platform provides payment infrastructure for businesses seeking to avoid vendor lock-in while accessing a global ecosystem of payment services. Spreedly’s approach emphasizes flexibility and openness, allowing merchants to mix and match different payment providers based on their specific needs.

Spreedly serves over 100 countries and focuses particularly on platforms, marketplaces, and fintechs that need to offer payment flexibility to their own customers. Their experience with regulatory compliance across different jurisdictions makes them valuable for businesses operating internationally.

Key Features:

- Single API access to global payment ecosystem

- PSP-agnostic platform with vendor independence

- Extensive international coverage across 100+ countries

- Platform and marketplace-focused solutions

- Regulatory compliance automation across jurisdictions

Pricing: Volume-based pricing with enterprise plans available

Best For: Platforms, marketplaces, and fintechs needing global payment flexibility

4. Stripe Connect

Stripe Connect represents Stripe’s payment orchestration solution designed specifically for platforms, marketplaces, and businesses managing multi-party payments. The platform combines Stripe’s payment processing capabilities with orchestration features for complex payment workflows.

Connect excels at handling marketplace scenarios where payments need to be split between multiple parties, with automated payouts, tax calculation, and compliance management. The platform provides onboarding tools for sub-merchants, customizable payment experiences, and global payment method support.

Stripe’s global infrastructure and regulatory expertise make Connect particularly valuable for businesses expanding internationally. The platform handles local payment methods, currency conversion, and regulatory compliance across multiple jurisdictions.

Key Features:

- Multi-party payment orchestration and splitting

- Global payment method and currency support

- Automated sub-merchant onboarding and compliance

- Customizable payment experiences and branding

- Integrated financial services including cards and lending

Pricing: Standard Stripe processing fees plus Connect-specific pricing

Best For: Platforms, marketplaces, and businesses with multi-party payment requirements

5. Adyen for Platforms

Adyen provides enterprise-grade payment orchestration through their platform solutions, targeting large businesses and marketplaces requiring comprehensive payment infrastructure. The platform combines payment processing with orchestration capabilities in a unified solution.

Adyen’s strength lies in their global acquiring capabilities and direct connections to card networks, which enables optimized routing and improved authorization rates. Their platform includes over 250 payment methods and supports both online and in-person transactions through unified infrastructure.

The platform particularly excels for businesses requiring sophisticated risk management, detailed analytics, and enterprise-level support. Adyen’s focus on large enterprises means their solutions accommodate complex requirements and high transaction volumes.

Key Features:

- Global acquiring with direct card network connections

- 250+ payment methods and global coverage

- Unified online and in-person payment infrastructure

- Enterprise-grade fraud prevention and risk management

- Advanced analytics and business intelligence

Pricing: Custom enterprise pricing based on volume and requirements

Best For: Large enterprises and high-volume businesses requiring comprehensive payment infrastructure

6. Akurateco

Akurateco provides white-label payment orchestration software that enables businesses to build their own payment platforms with comprehensive PSP connectivity. Based in Amsterdam, the company offers over 500 payment connectors through a single integration.

The platform focuses on helping businesses increase authorization rates through smart routing and automated retry capabilities, with clients typically seeing approval rate improvements up to 20% and conversion rate increases up to 30% through cascading payment attempts.

Akurateco’s white-label approach appeals to businesses wanting to maintain their brand identity while offering sophisticated payment capabilities. Their platform includes consolidated reporting, automated reconciliation, and comprehensive analytics across all connected providers.

Key Features:

- White-label platform with 500+ payment connectors

- Smart routing and cascading for improved approval rates

- Consolidated analytics and reporting across all PSPs

- Automated reconciliation and settlement tools

- Customizable merchant dashboards and interfaces

Pricing: Based on transaction volume with setup and monthly fees

Best For: Businesses wanting white-label payment platform capabilities with extensive PSP connectivity

7. IXOPAY

IXOPAY provides an enterprise-grade payment orchestration platform with modular architecture allowing businesses to select specific components or implement a complete payment solution. The platform connects to over 200 PSPs and supports 300+ payment methods globally.

The company emphasizes risk-based routing combined with cascading and fallback features, typically achieving 15% increases in payment acceptance rates for their clients. IXOPAY’s platform includes automated card updating, fraud prevention, and comprehensive settlement tools.

IXOPAY’s modular approach allows businesses to start with specific components and expand their usage over time, making it suitable for companies with evolving payment requirements or existing infrastructure they want to enhance gradually.

Key Features:

- Modular platform architecture with flexible implementation

- 200+ PSP connections and 300+ payment methods

- Risk-based routing with 15% average acceptance rate improvement

- Automated card updating and payment continuity

- Comprehensive fraud prevention and settlement automation

Pricing: Enterprise pricing based on modules selected and transaction volume

Best For: Enterprise businesses wanting modular payment orchestration with extensive global coverage

Choosing the Right Orchestration Platform

Selecting a payment orchestration platform depends on business size, technical requirements, geographic coverage needs, and specific use cases. Consider these factors when evaluating options.

For No-Code Optimization: Primer offers the most sophisticated workflow builder for businesses wanting to optimize payments without engineering resources. Their drag-and-drop interface enables rapid experimentation and optimization by non-technical teams.

For Enterprise Requirements: Gr4vy and IXOPAY provide the most comprehensive enterprise features for businesses with complex routing requirements, high transaction volumes, and sophisticated compliance needs.

For Platform Businesses: Stripe Connect and Spreedly excel at serving platforms, marketplaces, and fintechs that need to offer payment capabilities to their own customers while maintaining flexibility and avoiding vendor lock-in.

For Global Operations: Adyen provides the strongest international infrastructure for businesses requiring local acquiring capabilities and payment methods across multiple regions with unified reporting and management.

For White-Label Solutions: Akurateco offers the most comprehensive white-label capabilities for businesses wanting to build their own payment platform while leveraging extensive PSP connectivity.

For Flexible Implementation: IXOPAY’s modular architecture works well for businesses wanting to implement orchestration gradually or integrate with existing payment infrastructure.

Implementation Considerations and Success Factors

Successful payment orchestration implementation requires careful planning around integration complexity, routing strategy, and performance monitoring. Most platforms offer sandbox environments for testing before production deployment.

Integration Planning should account for existing payment infrastructure, technical resources, and timeline requirements. While modern platforms offer simplified integration, complex routing rules and fraud prevention configurations require careful design and testing.

Routing Strategy Development involves analyzing current payment performance, identifying optimization opportunities, and designing rules that balance approval rates, costs, and customer experience. Most businesses start with simple geographic routing before implementing more sophisticated logic.

Performance Monitoring becomes critical for optimization success. Platforms provide extensive analytics, but businesses need processes for regularly reviewing performance metrics, adjusting routing rules, and testing new providers or payment methods.

Compliance Management requires understanding how orchestration affects regulatory requirements, especially for businesses operating internationally. Leading platforms automate much of this complexity, but businesses must ensure their chosen solution meets specific regulatory needs.

The Strategic Value of Payment Infrastructure Investment

Payment orchestration represents more than operational efficiency – it provides strategic flexibility that becomes increasingly valuable as businesses grow and expand globally. Companies with optimized payment infrastructure can enter new markets faster, experiment with pricing models more easily, and adapt to changing customer preferences without technical constraints.

The visual and user experience aspects of payment optimization often get overlooked despite their significant impact on conversion rates. While orchestration platforms handle the technical routing and processing, the customer-facing payment experience requires professional design and optimization.

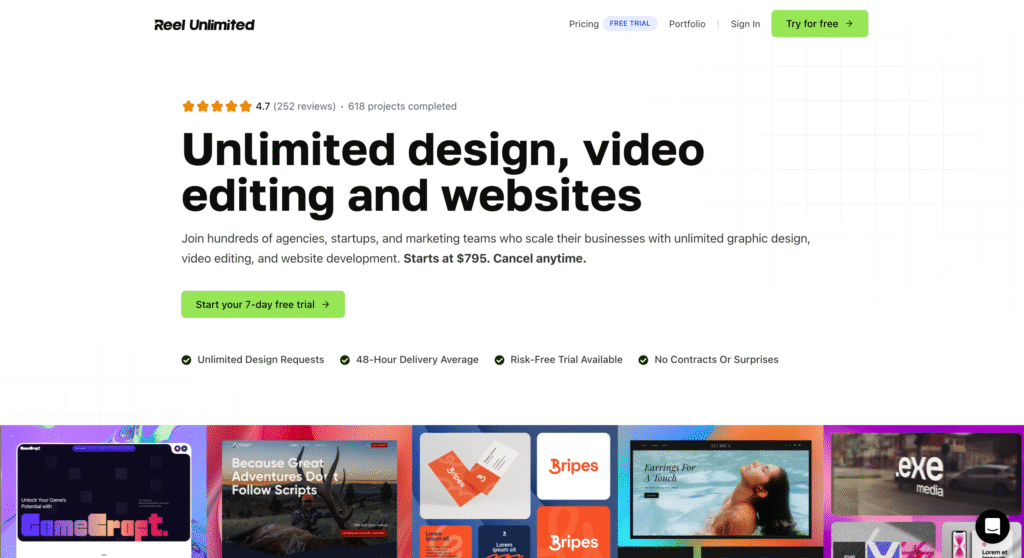

How Professional Design Supports Payment Success

Reel Unlimited provides unlimited design services that help businesses create optimized checkout experiences and payment-related marketing materials. Our design team understands that successful payment orchestration requires more than just technical infrastructure – it needs professionally designed customer touchpoints that build trust and reduce abandonment.

Since our founding in 2021, we’ve helped companies including Walnut, Pattern, and Canix create conversion-optimized designs that support their payment and business growth strategies. We understand that businesses investing in payment orchestration need corresponding design quality to maximize their infrastructure investment.

Design Services for Payment Optimization:

- High-converting checkout page design optimized for multiple payment methods

- Trust-building landing pages that reduce payment hesitation

- Professional branding and visual identity that supports payment credibility

- Email marketing designs for payment confirmations and customer communications

- Mobile-optimized payment interfaces for improved conversion rates

- A/B testing creative assets for checkout flow optimization

Our service options accommodate businesses at different optimization stages. Monthly subscriptions provide ongoing design capacity for continuous checkout testing and optimization. 30-day services offer intensive design support for major payment infrastructure launches or checkout redesigns.

The combination of design and video editing under our Graphics service provides more value than traditional design-only services, giving businesses both static and motion graphics for payment pages, explainer videos about payment security, and customer education materials.

Transform your payment infrastructure investment into conversion-driving design assets. Start your 7-day trial to experience our design quality with one completed project, or explore our pricing to see which service option best supports your payment optimization and business growth initiatives.