Choosing the right bank for your startup can make the difference between smooth financial operations and constant administrative headaches. Modern startups need banking partners that understand their unique challenges: irregular cash flow, global operations, remote teams, and the need for rapid scaling without traditional credit histories.

Traditional banks often struggle to serve startups effectively, requiring lengthy approval processes, high minimum balances, and offering limited digital features. This gap has created opportunities for neobanks and fintech companies to build banking services specifically designed for growing businesses.

This guide covers the best banking options for startups in 2025, including both traditional banks and modern alternatives, organized by geographic availability and business needs.

The Evolution of Startup Banking

Startup banking has changed dramatically over the past decade. Where founders once had few options beyond local community banks or major national institutions, today’s entrepreneurs can choose from purpose-built financial platforms designed specifically for growing businesses.

Modern startup banks understand that early-stage companies operate differently than established businesses. They need accounts that can handle international payments, support remote teams, provide spending controls for distributed workforces, and offer lending options based on business potential rather than just credit scores and collateral.

The banking landscape now includes three main categories: traditional banks that have improved their digital offerings, neobanks that operate entirely online, and spending management platforms that combine banking services with expense management tools.

Geographic Considerations for Startup Banking

Your startup’s location significantly impacts which banking options are available. Banking regulations vary by country and region, with some platforms available globally while others serve specific markets.

United States has the most diverse startup banking ecosystem, with options ranging from traditional institutions like Silicon Valley Bank to innovative platforms like Mercury and Brex. US-based startups benefit from the largest selection of specialized business banking services.

Europe offers strong regional options like Revolut (UK/EEA) and Pleo, alongside global platforms. European startups often need multi-currency capabilities due to cross-border operations within the EU market.

Asia-Pacific regions have seen rapid growth in fintech banking, with platforms like Aspire serving multiple countries and specialized services for markets like Hong Kong and Singapore through providers like Statrys.

Canada has its own ecosystem with platforms like Venn, while other markets may rely more heavily on global platforms or traditional banks with improved digital services.

Understanding Banking Categories

Traditional Banks offer full banking services backed by established institutions, with physical branches and complete regulatory protection. They typically provide higher account limits and more lending options but may lack the modern features and user experience that startups prefer.

Neobanks operate primarily online and focus on user experience and modern features. Most partner with traditional banks for actual banking services while providing the interface and additional tools. They often offer better expense management, international capabilities, and startup-friendly approval processes.

Spending Management Platforms combine banking services with expense management, offering corporate cards, bill pay, and financial controls. These platforms excel at helping startups manage distributed teams and control spending but may have limitations on traditional banking services.

Multi-Currency Platforms specialize in international operations, offering accounts in multiple currencies with competitive foreign exchange rates. Essential for startups with global operations, remote international teams, or significant cross-border transactions.

Top Global and Multi-Region Startup Banks

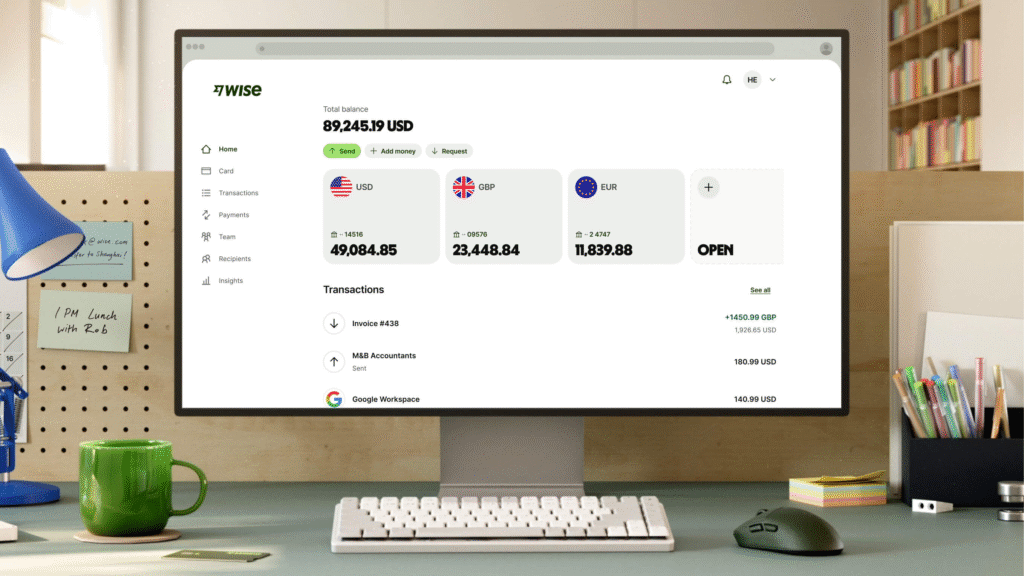

Wise

Available: Most countries globally Best for: International operations and multi-currency needs

Wise offers multi-currency business accounts that hold 50+ currencies with competitive exchange rates using mid-market pricing. The platform excels at international payments and receiving money in multiple currencies, making it ideal for startups with global operations.

Key features include local bank details in multiple countries, international debit cards, and integration with accounting software. Wise charges transparent fees with no hidden markups on currency conversion, though they do charge transaction fees for certain services.

Revolut Business

Available: United Kingdom, EEA, United States (limited) Best for: European startups and businesses needing multi-currency operations

Revolut provides business accounts with multi-currency capabilities, corporate cards, and expense management tools. The platform offers different tiers from free accounts to premium options with additional features.

European businesses can access local IBAN details, while the spending controls and real-time notifications help manage distributed teams. The platform includes integrations with accounting software and offers competitive foreign exchange rates.

Brex

Available: United States Best for: US startups with significant spend management needs

Brex combines corporate cards with business banking, offering higher credit limits than traditional banks and approval based on business metrics rather than personal credit scores. The platform provides excellent expense management tools and integrations.

Features include automated expense categorization, bill pay services, and rewards programs. Brex focuses on technology companies and venture-funded startups, offering specialized features for these business types.

Top Startup Banks in the United States

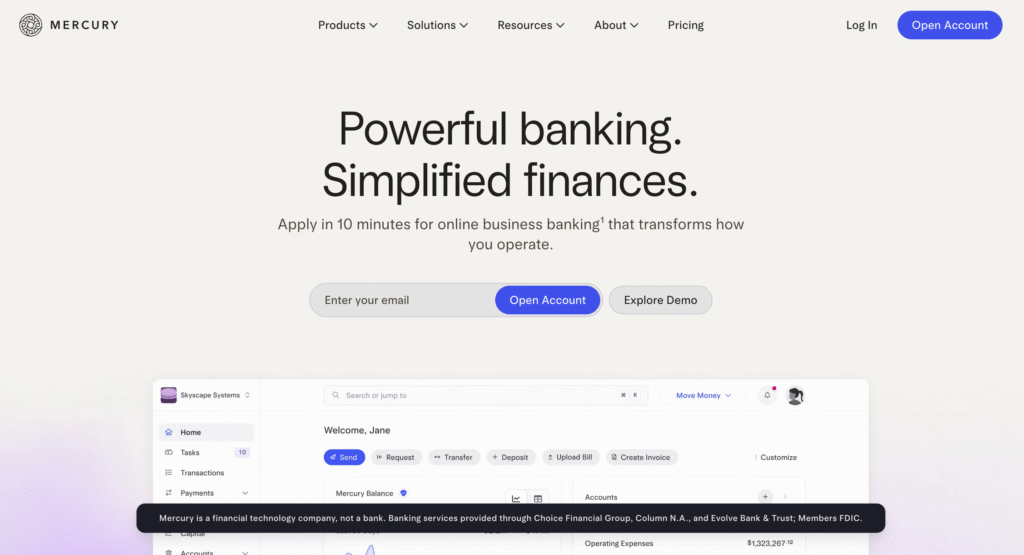

Mercury

Available: United States, US Virgin Islands, British Virgin Islands, Cayman Islands, UAE, Bahamas, Bermuda, Singapore, Jersey Best for: Tech startups and venture-funded companies

Mercury offers business banking designed specifically for startups, with no minimum balance requirements and strong integrations with business tools. The platform provides checking and savings accounts with competitive interest rates.

The service includes features like same-day ACH transfers, wire transfers, and integration with accounting platforms. Mercury focuses on providing banking services that scale with growing businesses without the complexity of traditional banks.

Slash

Available: United States Best for: High-growth companies with significant spending

Slash provides business banking with high-yield accounts and unlimited 2% cashback on corporate cards for Pro customers. The platform offers working capital options and focuses on businesses with substantial transaction volumes.

Features include crypto on/off ramps, developer APIs, and multi-entity management capabilities. Slash targets businesses that need advanced financial tools and can benefit from their cashback programs.

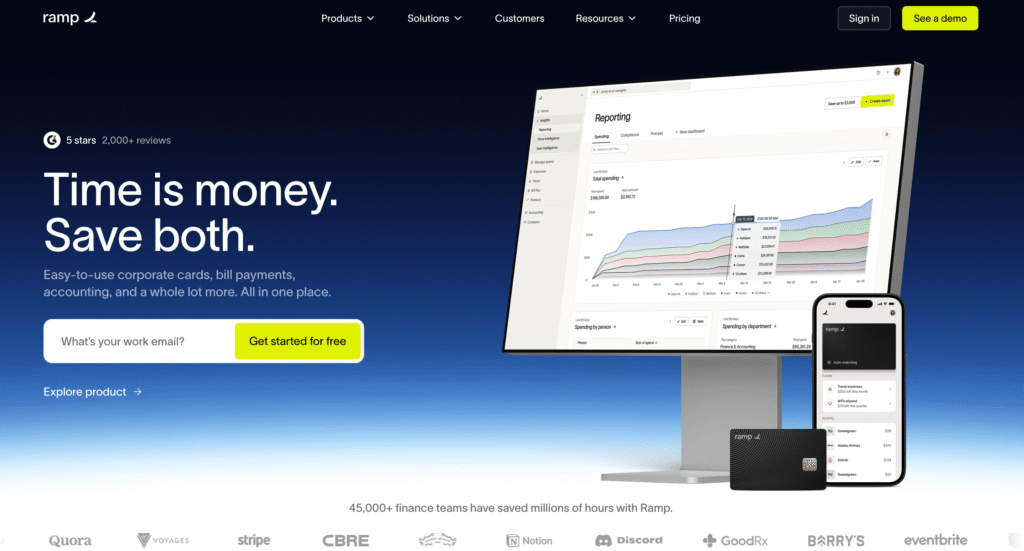

Ramp

Available: United States Best for: Companies focused on spend optimization

Ramp offers corporate cards and expense management with a focus on helping businesses save money. The platform provides insights into spending patterns and automated controls to prevent unnecessary expenses.

The service includes bill pay automation, integration with accounting systems, and detailed spend analytics. Ramp works well for startups that want to maintain tight control over expenses while scaling operations.

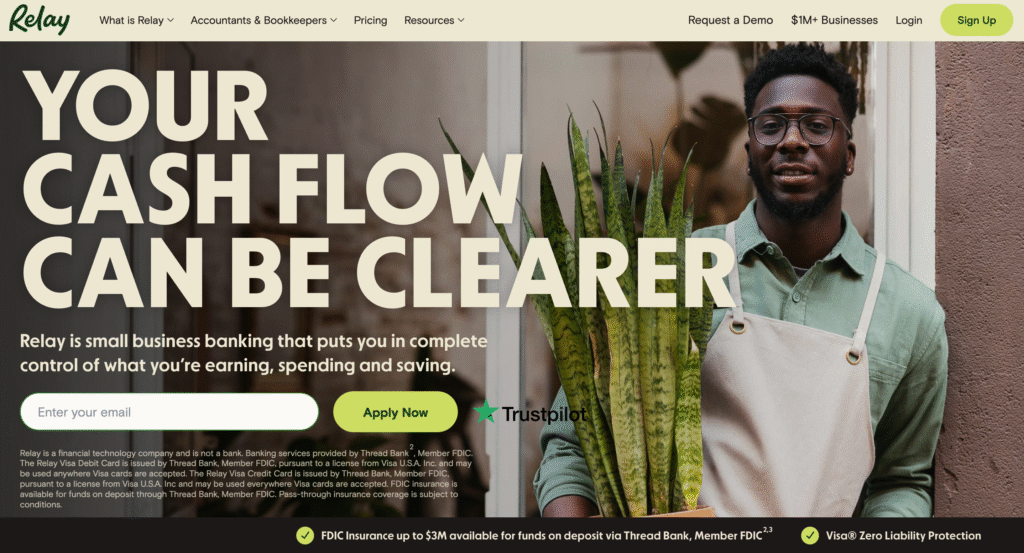

Relay Financial

Available: United States Best for: Small businesses and freelancers

Relay Financial provides fee-free business banking with checking accounts and integration with accounting software. The platform offers up to 20 separate checking accounts to help organize business finances.

Features include no monthly fees, no minimum balance requirements, and simple integrations with tools like QuickBooks and Xero. Relay works well for smaller startups and service-based businesses.

Top Startup Banks in Europe and the UK

Most European startups can access global platforms like Wise and Revolut Business, which offer strong multi-currency capabilities and local banking features for EU operations. Regional European neobanks and traditional banks with improved digital services also serve this market.

Top Startup Banks in Asia-Pacific

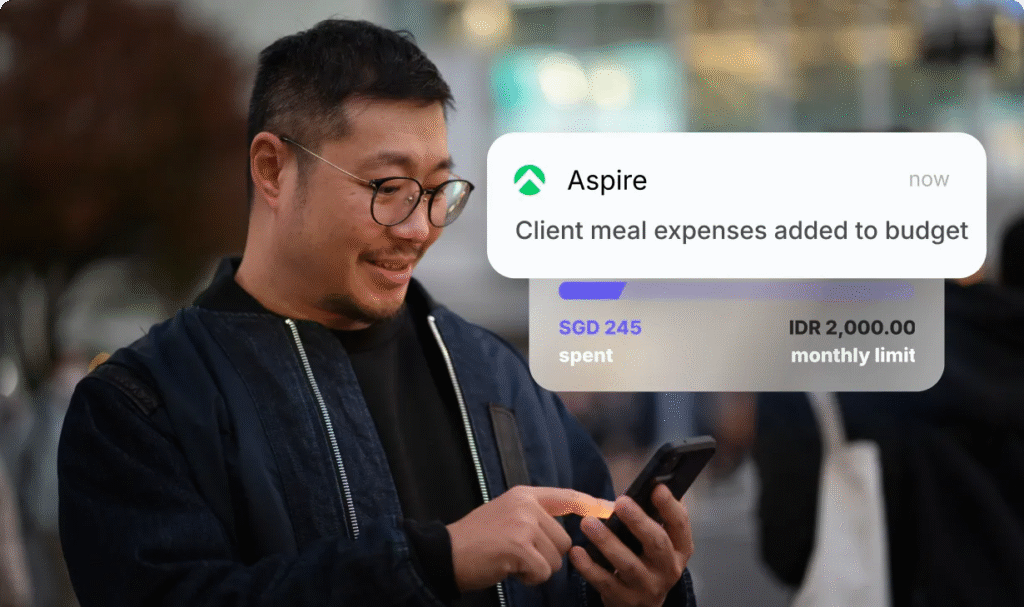

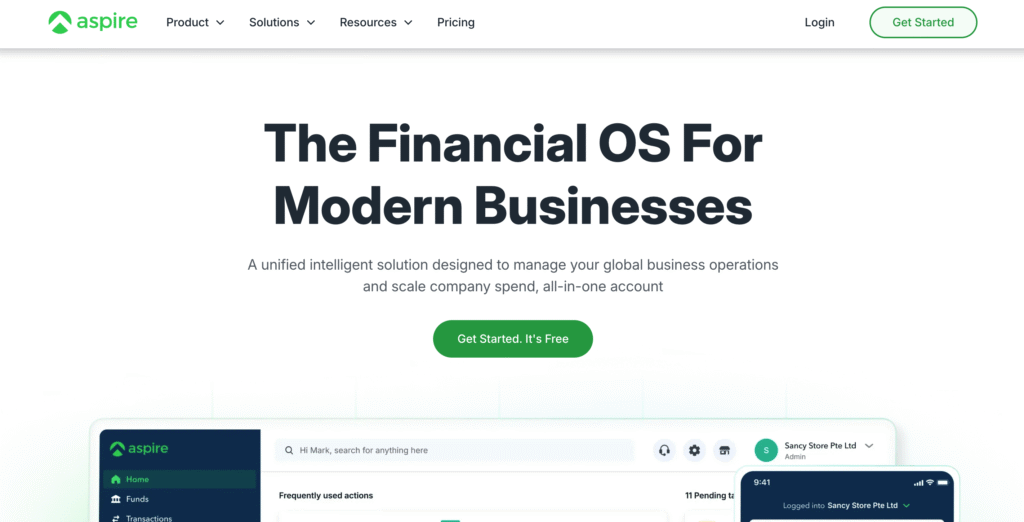

Aspire

Available: Hong Kong, Singapore, UK, US, Australia, Canada, Netherlands Best for: International businesses with operations across multiple regions

Aspire offers multi-currency business accounts with local payment capabilities and corporate cards. The platform provides expense management tools and supports businesses operating across different countries.

Features include multi-currency accounts, virtual and physical cards, and integrations with accounting software. Aspire focuses on businesses that need international banking capabilities with local support in multiple regions.

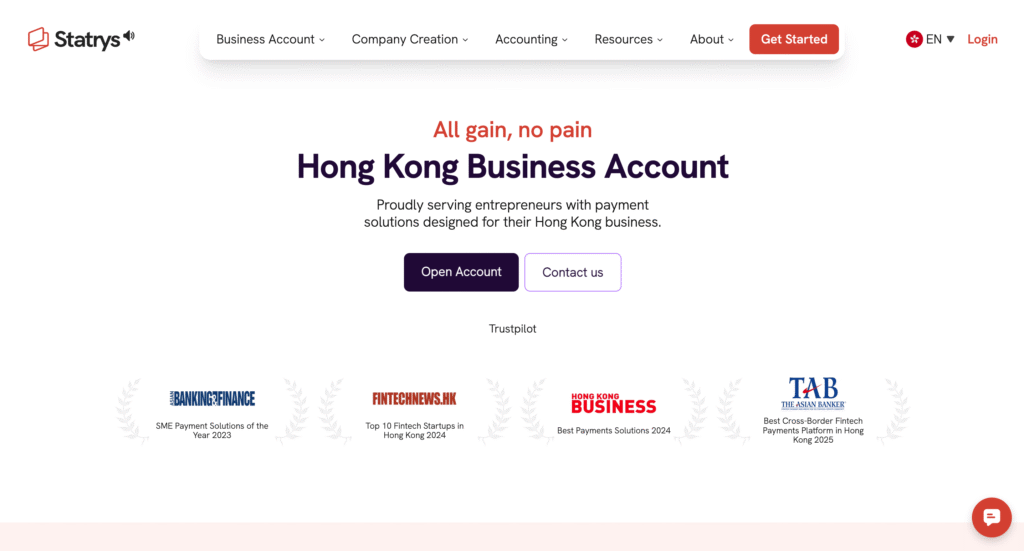

Statrys

Available: Hong Kong, Singapore Best for: Hong Kong and Singapore-based startups with multi-currency needs

Statrys provides multi-currency business accounts supporting 11 major currencies with competitive foreign exchange rates. The platform offers dedicated account managers and focuses on businesses with international operations.

Features include local payment capabilities, foreign exchange services, and integration with business tools. Statrys works well for startups in major Asian financial centers that need sophisticated currency management.

Top Startup Banks in Canada

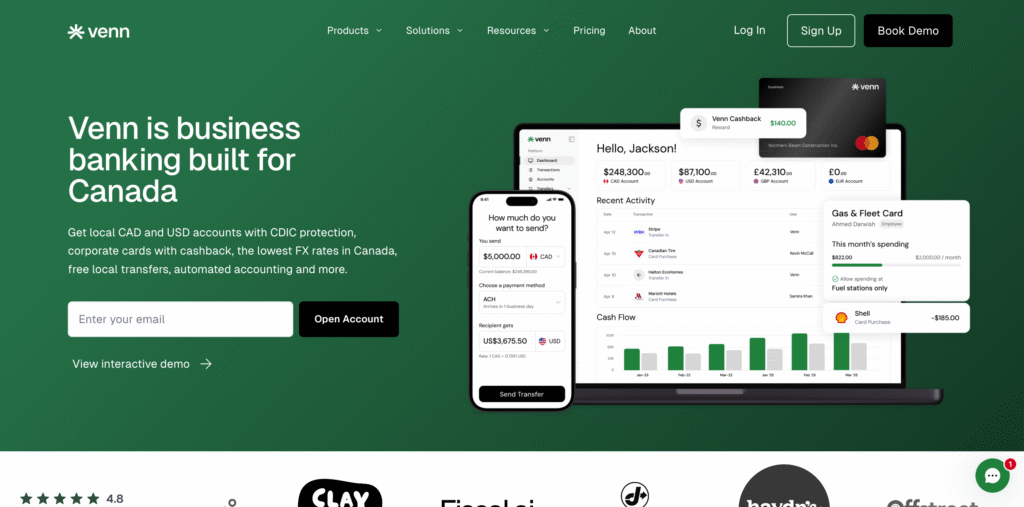

Venn

Available: Canada Best for: Canadian businesses with multi-currency operations

Venn offers Canadian business banking with CAD and USD accounts, competitive foreign exchange rates, and corporate cards with cashback. The platform provides CDIC protection and focuses on Canadian businesses with international operations.

Features include automated accounting integrations, expense management tools, and multi-currency invoicing capabilities. Venn combines traditional banking stability with modern fintech features.

Additional Banking Options

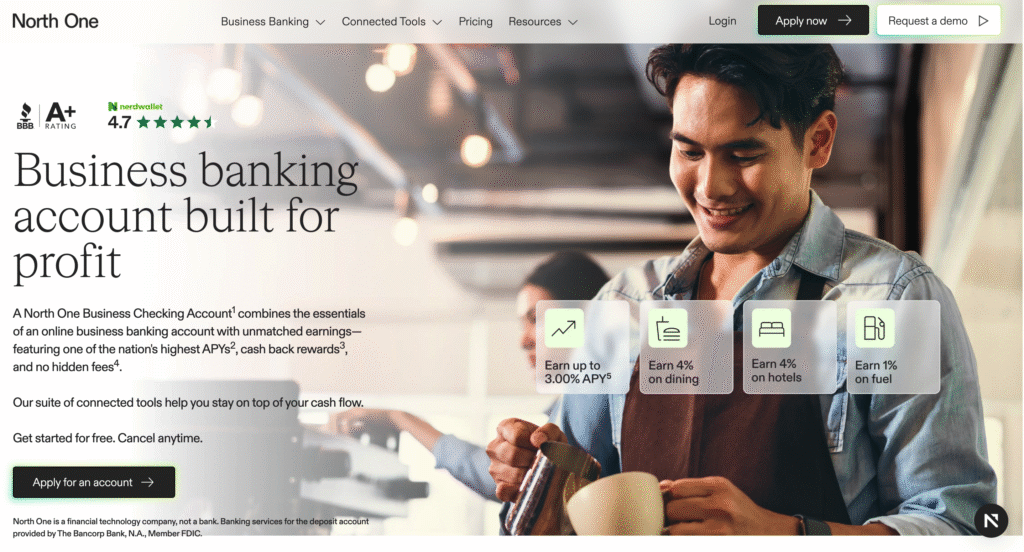

North One Business Checking (US) – High-yield business accounts with cashback rewards and no hidden fees. Good for businesses that maintain higher balances and want to earn on their deposits.

Novo (US) – Simple business banking with no monthly fees and integration with business tools. Focuses on small businesses and freelancers who need basic banking without complexity.

PayPal Business (Global) – Business accounts with payment processing and global reach. Works well for e-commerce businesses and companies that already use PayPal for transactions.

Airwallex (Global) – Multi-currency accounts with strong international payment capabilities. Good for businesses with significant cross-border operations and marketplace integrations.

Payoneer (Global) – Business accounts focused on international payments and marketplace integrations. Popular with freelancers and businesses that receive payments from international clients.

Reel Unlimited’s Banking Recommendations

At Reel Unlimited, we’ve worked with various banking platforms while serving over 500 clients globally including Synthesia, Pattern, and Canix. Our experience as a design platform with subscription services, global contractors, and international operations has taught us what matters most in startup banking.

Based on our experience managing global operations, paying international contractors, handling subscription billing, and supporting clients across multiple currencies, we recommend these banking platforms:

Our Top 5 Recommendations

1. Wise – Essential for any startup with international operations. We use Wise for managing payments to our global team across 16 countries and handling multi-currency transactions with transparent, competitive rates.

2. Aspire – Excellent for startups operating across multiple regions. The multi-currency capabilities and local payment options work well for businesses like ours that serve clients in different countries.

3. Statrys – Strong choice for Asia-Pacific operations. Their dedicated account manager approach and multi-currency expertise align well with businesses that need personalized banking support.

4. Revolut Business – Good option for European startups and businesses needing strong expense management tools combined with banking services.

5. Brex – Ideal for US technology startups with significant spending needs. The corporate card features and expense management tools work well for growing teams.

Why These Platforms Work for Modern Startups

These platforms understand that today’s startups operate differently than traditional businesses. They provide the international capabilities, digital-first experiences, and scaling features that growing companies need.

As a design subscription service, we need banking that handles recurring billing, international contractor payments, and multi-currency operations smoothly. These platforms have proven reliable for businesses with similar operational requirements.

Choosing the Right Banking Platform

Consider these factors when selecting banking for your startup:

Geographic requirements – Ensure the platform serves your business location and any countries where you operate or plan to expand.

Currency needs – If you handle multiple currencies, prioritize platforms with strong foreign exchange capabilities and competitive rates.

Team structure – Distributed teams benefit from platforms with expense management tools, virtual cards, and spending controls.

Growth plans – Choose platforms that can scale with your business rather than requiring migration as you grow.

Integration requirements – Consider how the banking platform integrates with your existing business tools and accounting software.

Cost structure – Understand the fee structure and ensure it aligns with your transaction patterns and account usage.

Getting Started with Startup Banking

Most modern banking platforms offer quick online applications that can be completed in minutes rather than the weeks required by traditional banks. Start by identifying your primary needs and geographic requirements, then apply to 2-3 platforms to compare their offerings.

Many platforms offer free accounts or low minimum balance requirements, making it feasible to maintain accounts with multiple providers while you evaluate which works best for your specific needs.

The banking landscape continues evolving rapidly, with new features and geographic expansion happening regularly. Stay informed about updates to platforms you use and be ready to adapt your banking strategy as your startup grows and your needs change.

Banking choice impacts every aspect of your startup’s financial operations. Choose platforms that support your growth rather than creating obstacles, and don’t hesitate to switch if your current banking isn’t meeting your evolving needs.

Build Your Startup’s Professional Brand Alongside Smart Banking

Just as choosing the right banking platform is critical for your startup’s financial operations, having professional design and branding is essential for building credibility and attracting customers. Modern startups need more than just functional banking – they need visual assets that communicate professionalism and build trust with potential clients, investors, and partners.

How Reel Unlimited Supports Growing Startups

Reel Unlimited provides unlimited design services that help startups create professional branding to support their business growth. Our design team creates everything growing companies need – logos, websites, marketing materials, social media graphics, and video content that helps your startup stand out in competitive markets.

Since our founding in 2021, we’ve helped hundreds of clients including Synthesia, Pattern, Canix, and Outmin build strong visual brands that support their business goals. We understand that startups need consistent, professional design work to maximize their marketing effectiveness while maintaining lean operations.

What We Create for Growing Startups:

- Professional logos and brand identity systems

- Modern websites and landing pages optimized for conversions

- Marketing materials including presentations and sales decks

- Social media graphics and templates for consistent branding

- Email marketing designs and newsletter templates

- Video content including explainer videos and promotional materials

Our service options work well for businesses at different stages. 30-day services provide intensive design capacity for product launches, funding rounds, or major campaign periods. Monthly subscriptions offer better value for ongoing design needs with additional features like white-label capabilities perfect for agencies and service providers.

The combination of design and video editing under our Graphics service provides more value than traditional design-only services, giving you both static and motion graphics for comprehensive marketing campaigns. Our Websites service handles complete projects from initial design through development, perfect for creating professional websites that convert visitors into customers.

Start building your startup’s professional foundation today. Begin your 7-day trial to experience our design quality with one completed project, or explore our pricing to see which service option best supports your startup’s growth goals.